Buying A Business In Canada, How Much Money Is Required?

Buying a business in Canada requires a significant financial commitment, and the amount needed can vary widely depending on several factors, such as the type of business, its size, location, and profitability.

The cost of buying a business in Canada varies widely based on the industry, size, and profitability. Small businesses can be acquired for as little as $50,000 to $200,000, while mid-sized businesses might range from $200,000 to $1 million or more. More extensive or highly profitable businesses can cost several million dollars. Additional costs include due diligence, legal fees, and working capital. Financing options like loans and investors can help mitigate upfront costs. However, it’s crucial to emphasize the importance of conducting thorough market research and financial analysis. This will help you determine the total investment required for the specific business you’re interested in, ensuring you make an informed decision.

Here is a comprehensive breakdown of the costs associated with buying a business in Canada, providing you with a thorough understanding and instilling confidence in your investment decision:

Factors Affecting the Cost of Buying a Business in Canada

It’s crucial to grasp the factors that influence the cost of buying a business in Canada. The size of the business, its industry, location, financial performance, assets, market conditions, and seller motivations all come into play. Additionally, due diligence, legal fees, and financing terms can significantly impact the overall expense. Economic factors like interest rates and regulatory requirements also have a role. Understanding these factors allows you to make informed decisions and feel more confident in your investment.

1. Type of Business

Each industry presents unique opportunities and challenges. For instance, while a small retail store may have a lower initial cost, it could offer a steady stream of customers and potentially high returns on investment, painting a promising picture for your business venture. On the other hand, a manufacturing plant or a tech company, though more expensive to acquire, could yield even higher returns, further fueling your optimism.

2. Location

Businesses in major cities like Toronto, Vancouver, and Montreal may come with a higher price tag, but they also offer a more extensive customer base and more growth opportunities. Conversely, companies in smaller towns or rural areas may be more affordable, but they could also face challenges in terms of market reach.

3. Size and Scale

The purchase price is impacted by the number of employees, annual revenue, and market share.

4. Profitability

is a critical factor in determining a business’s price. Companies with higher profit margins and strong financials generally command higher prices. Profitability is more than just a number; it’s a reassurance of a business’s value and ability to generate returns for its owners. This reassurance should help boost your confidence in your investment decision.

5. Assets Included

The price is factored into the value of physical assets (like real estate, equipment, and inventory) and intangible assets. Intangible assets, such as brand value and intellectual property, are not physical but can be valuable and contribute significantly to a business’s overall worth. For instance, a well-known brand can attract customers and command higher prices, while a patented technology can provide a competitive advantage. Understanding the value of these intangible assets is crucial when evaluating the acquisition cost, ensuring you are well-prepared for the business acquisition process.

Estimated Costs by Business Type

Estimated costs for buying a business in Canada can vary significantly by type. Small businesses typically cost between CAD 50,000 and 500,000, while mid-sized companies can range from CAD 500,000 to several million. Retail and service companies are generally more affordable, whereas manufacturing, tech, and franchises often require higher investments due to equipment, inventory, and brand value. Here is a breakdown of the estimated costs for different types of businesses:

1. Small Retail Businesses

Small retail stores or service-based businesses can cost CAD 50,000 to CAD 100,000.

2. Restaurants and Cafés

Depending on size, location, and reputation, these can range from CAD 100,000 to CAD 500,000 or more.

3. Professional Services Firms

Depending on their client base and revenue, accounting, legal, or consulting firms may cost between CAD 200,000 and CAD 1 million.

4. Manufacturing Businesses

Depending on the scale of operations and the value of machinery and equipment, costs can range from CAD 500,000 to several million dollars.

5. Technology Companies

Startups or smaller tech firms might be priced between CAD 200,000 to CAD 2 million, while more extensive or established tech companies can command prices in the tens of millions.

6. Franchises

Buy a franchise in Canada as a foreigner and its cost varies widely. Smaller local franchises cost CAD 50,000 to CAD 200,000, while larger, well-known franchises can cost between CAD 500,000 and several million dollars.

Business Additional Costs to Consider

When buying a business in Canada, it’s important to consider additional costs. These include due diligence expenses (legal, accounting, and inspection fees), financing costs (loan interest and fees), transaction fees (broker commissions), and transition expenses (training and marketing). Working capital requirements, potential renovations, licensing, and regulatory compliance also contribute to the total investment needed.

1. Due Diligence

Legal and accounting fees for conducting due diligence, which is a thorough investigation of a business’s financial records, legal contracts, and operational procedures to ensure there are no hidden liabilities or risks, can range from CAD 5,000 to CAD 25,000 or more, depending on the complexity of the companies.

2. Financing Costs

Consider interest rates and loan fees if you’re financing the purchase through a loan. Commercial loan interest rates in Canada typically range from 3% to 10%.

3. Working Capital

Sufficient working capital, the difference between a business’s current assets and liabilities, representing the funds available for day-to-day operations, is essential to cover the companies’ operational costs during the transition period. This amount can vary widely depending on the business type and size.

4. Licensing and Permits

Depending on the business, you may need to renew or acquire new licenses and permits, which can cost several hundred to several thousand dollars.

5. Transition Costs

The ownership transition costs, including training, marketing, and rebranding, can range from CAD 10,000 to CAD 50,000. These costs are incurred when the business changes hands and the new owner must establish its market presence.

Examples of Business Purchase Prices in Canada

The cost associated with buying a business in Canada varies. The small retail companies typically sell for CAD 50,000-200,000. Depending on location and size, restaurants often range from CAD 100,000 to 500,000. Manufacturing companies can cost CAD 500,000-5 million or more. Tech startups and franchises vary widely, from CAD 100,000 to several million, based on assets and market position. Here is an example of a business purchase process in Canada:

Small Local Café in Toronto

- Purchase price: CAD 150,000

- Additional costs (due diligence, working capital, etc.): CAD 30,000

- Total: CAD 180,000

Medium-Sized Accounting Firm in Vancouver

- Purchase price: CAD 600,000

- Additional costs (due diligence, working capital, etc.): CAD 50,000

- Total: CAD 650,000

Manufacturing Plant in Ontario

- Purchase price: CAD 3 million

- Additional costs (due diligence, working capital, etc.): CAD 200,000

- Total: CAD 3.2 million

Tech Startup in Montreal

- Purchase price: CAD 1.2 million

- Additional costs (due diligence, working capital, etc.): CAD 100,000

- Total: CAD 1.3 million

Business Funding Options in Canada

Personal savings, bank loans, and Small Business Administration (SBA) loans are funding options for buying a business in Canada. Other sources are venturing capital, private equity, seller financing, and crowdfunding. Government grants and programs also support specific industries. Each option has distinct terms, interest rates, and qualification criteria.

1. Personal Savings

Many entrepreneurs use their savings to buy business in Canada for PR.

2. Bank Loans

Business loans from banks or credit unions are standard. To secure a commercial loan, you typically need a solid business plan. This document outlines your companies’ goals and how you plan to achieve them, as well as a good credit history and collateral. The interest rates and terms of the loan will depend on your financial situation and the lender’s policies.

3. Seller Financing

The seller may finance part of the purchase price. This is known as ‘seller financing’ or ‘vendor take-back financing ‘. It can be beneficial as it reduces the amount of upfront capital required and can indicate the seller’s confidence in the business’s future success. However, it’s essential to consider the terms and conditions of the financing agreement and the potential impact on your cash flow.

4. Investors

Equity investors or venture capitalists can provide the necessary funds in exchange for a company share. This means they become part owners of the business and may have a say in its operations and decision-making. This can be a beneficial option for companies that require significant investment but may not be suitable for all types of businesses or all stages of business development.

5. Government Programs for buying a business in Canada

Rest assured, programs like the Canada Small Business Financing Program (CSBFP) are available to help you secure loans, providing the necessary financial support for your business acquisition. This reassurance should give you confidence in securing the required funding for your business venture in Canada.

Conclusion

The cost of buying a business in Canada varies greatly depending on numerous factors, including the type of business, its location, size, and profitability. By emphasizing the importance of thorough planning and understanding these costs, you can better prepare for your business acquisition and ensure you are fully aware of your financial commitment. On average, expect to invest between CAD 50,000 and CAD 200,000 for small companies, CAD 200,000 to CAD 1 million for medium-sized companies, and several million dollars for larger enterprises.

Careful planning, thorough due diligence, and understanding the financial requirements are essential to ensuring a successful business acquisition. Consider the inspiring example of a small local café in Toronto purchased for CAD 150,000 and has since thrived under new ownership. By utilizing professional advisors to navigate the complexities of the purchase process and secure the necessary funding, you can set yourself up for a prosperous company venture in Canada.

How Arnika Visa Can Help!

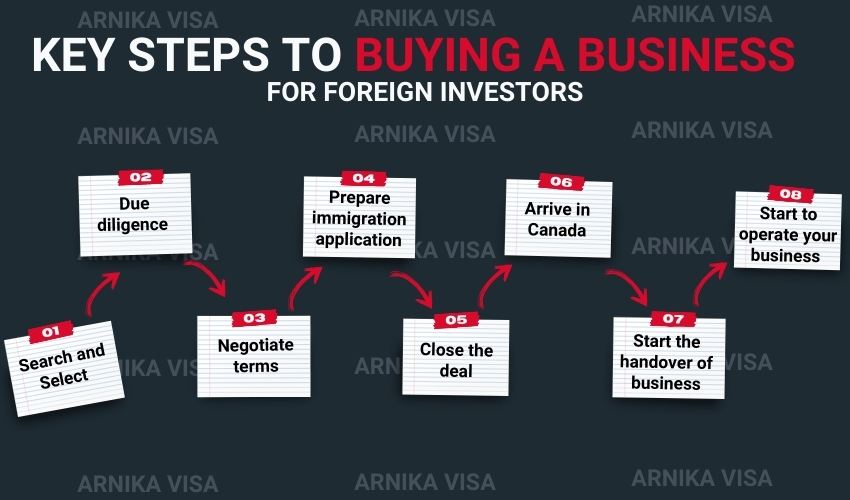

As a highly qualified and experienced Regulated Canadian Immigration Consultant (RCIC), Arnika Visa can assist you to buy a business in Canada for PR by providing comprehensive support throughout the process, with a particular focus on your immigration needs:

1. Business Identification

We take a personalized approach to helping our clients identify viable business opportunities that align with their unique skills, interests, and budgets. This tailored service makes them feel understood and catered to, enhancing their trust in your expertise. We also conduct market research to ensure the company meets its goals and immigration requirements.

2. Due Diligence

- We guide our clients through due diligence, including financial, legal, and operational assessments.

- We collaborate with financial advisors, accountants, and legal experts to verify the business’s health and compliance.

3. Financing Assistance

We can assist you in exploring various funding options, such as personal savings, bank loans, Small Business Administration (SBA) loans, venture capital, and government grants. We will work together to find the best option to buy business in Canada for PR. We can also help prepare the documentation for loan applications and financial assessments.

4. Immigration Advice and Visa Application

- We provide expert advice on how buying an existing business can support clients’ immigration goals, including meeting investor or entrepreneur visa program criteria.

- We assist with preparing and submitting relevant immigration applications, such as the Startup Visa Program, Provincial Nominee Programs (PNP), or the Entrepreneur Visa Program.

- We ensure that all necessary documentation, such as business plans and proof of funds, is included in the visa application.

- We guide clients through the visa application process, including interviews and compliance with immigration regulations.

5. Negotiation and Purchase

- We support clients in negotiating purchase terms, including price, payment schedules, and conditions.

- We help draft and review contracts to ensure favourable and secure terms.

6. Transition and Integration

- After the purchase, we can advise on post-purchase activities such as business integration, staff transition, and regulatory compliance. We aim to ensure a smooth transition and your successful operation in the Canadian business landscape. We can also offer guidance on adapting to the Canadian business environment and community.

- We assist with settling in Canada, finding housing schools, and understanding local services.

7. Ongoing Support

Our commitment to providing continued support and resources reassures clients that their success and integration in Canada is a long-term goal. This ongoing assistance instills a sense of security and confidence in their decision to buy a business in Canada. We keep clients informed about any changes in immigration or business regulations that could affect their investment.

By offering these services, we have helped numerous clients make informed decisions, secure financing, meet immigration requirements, and successfully integrate into the Canadian business landscape. This comprehensive approach supports both their business and immigration objectives, providing a smooth transition to their new life in Canada.

Buying A Business In Canada Related Articles

I want to buy a business in Canada. I have two industries in mind: event decorating and pet care/training. Hopefully, I have reached the right agency to point me in the right direction.

Yes, you’ve reached the right place. We can guide you through the process of buying a business in Canada. Please provide more details about your preferred industries, investment amount, and any specific business you’re considering.

I have investments to start a business in Canada. Can you apply my file?

Yes, We can help you apply for a business visa in Canada. To proceed with your application, please provide details about your investment, business plan, and any relevant documents.